Retirement Plan Lawsuits Now Implicating 403(b) Plans

Retirement Plan Lawsuits Aren’t Just for 401(k) Plans

Can 403(b) Plan Lawsuits be Far Behind?

READ THE ARTICLE

Over the last 10 years, there has been a rise in breach of fiduciary duty lawsuits against 401(k) plans including recent large payouts from Boeing ($57M) and Wells Fargo (32.5M). These lawsuits challenge Plan administration fees, the appropriateness of the fund lineup, fund fees, and the governance process that oversees the Plan.

BUT WHAT ABOUT 403(B) PLANS?

Similar to 401(k) plans, we have begun to see comparable lawsuits and payouts (e.g. Cassell v. Vanderbilt ($14.5M)) filed against 403(b) Plans – a trend that is expected to continue following a recent unanimous decision by the US Supreme Court in Hughes v. Northwestern University making it harder for lower courts to dismiss excessive fee lawsuits.

Per a report by the US Government Accountability Office (GAO) the large volume of 403(b) Plan assets and wide range of fees has raised suspicions:

1. More than $1T in 403(b) Plans assets (almost twice 401(k) assets subject to ERISA).

2. 1 bps to 2.01 bps in 403(b) record keeping and administration fees

3. 1 bps to 2.37 bps 403(b) investment fees

4. Funds with Assets Under Management (AUM) of greater than $1B tended to have lower fees than smaller plans

Since some of these plans are not subject to ERISA, they do not file 5500 Reports each year where plan expenses are reported, and some level of transparency is achieved. Permitting high operating costs and expense ratios without proper governance over time leads to lost earnings and potentially claims of negligence and breaches of fiduciary duty.

YOUR ROLE:

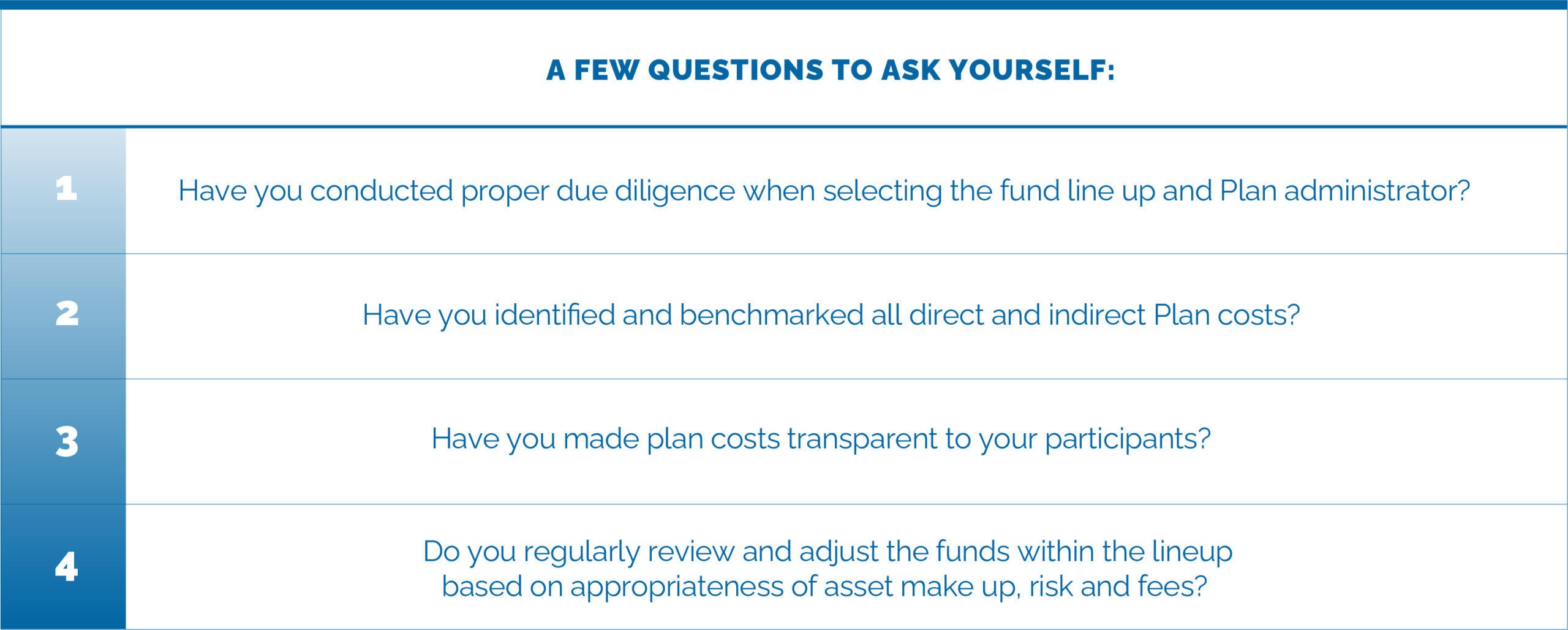

As a Plan fiduciary your actions, or in-actions, are what will be scrutinized by potential claimants. Compliance with fiduciary standards is crucial in both the initial establishment of your plan as well as in continuous on-going monitoring of vendors, investments, fees and regulations. The list of questions goes on and on. Ensuring that the Plan is operating with the best interests of its Plan participants is the ultimate test that you need to satisfy.

HOW OPTIMATUM CAN HELP:

To improve resilience against these risks, Optimatum supports clients from proactive foundational assessments to on-going Plan management and, while we hope you never need it, addressing plan operational challenges as they arise. The ultimate goal is to:

- Establish a foundation of compliance

- Right-size vendor relationships

- Decrease direct costs

- Address vendor challenges

- Reduce on-going compliance risks

Don’t allow your Plan to become a target for a lawsuit. Be proactive in implementing the best-in-class practices for governance and vendor management.

ABOUT OPTIMATUM:

Optimatum is a vendor management firm that focuses exclusively on the HR supply chain with turnkey solutions that improve the financial, operating performance, transparency and accountability of HR Benefit programs while still maintaining existing vendor relationships.

Our support of the HR workstream during the M&A lifecycle encompasses operational due diligence, day-one readiness and post day-one synergies. We assist sponsors in leveraging the aggregate purchasing power of their portfolio to capture value and drive margin expansion.