401(k) Plan Lawsuits Continue to Make Headlines

Since 2015, when Boeing agreed to pay $57 million to settle a lawsuit in which employees accused the company of mismanaging their 401(k) retirement plan, there’s been an alarming rise in breach of fiduciary duty complaints.i

READ THE ARTICLE

Most recently, in April 2022, Wells Fargo agreed to pay $32.5 million to settle a lawsuit where they were accused of investing in funds affiliated with the company, overlooking their high fees and underperformance measured against comparable retirement products. Similar claims across all industries include challenging Plan administration fees, the appropriateness of the fund lineup, fund fees, and the governance process that oversees the Plan.

CURRENT SITUATION

In addition to new tools and legal precedent, a 2022 Supreme Court ruling in Hughes v. Northwestern University has paved the way for lawsuits against 401(k) Plan sponsors to continue. With over 15 years of legacy issues to learn from, plan participants and their high-powered law firms have become more informed and sophisticated in their approach. With the development of new databases and analytical tools, fees and fund issues which were previously obscured, can quickly be identified and quantified. This has made it easier for legal firms who specialize in ERISA to file lawsuits against large and small plans alike. Regardless of the size of the plan, the fiduciary requirements for the Plan are the same.

YOUR ROLE:

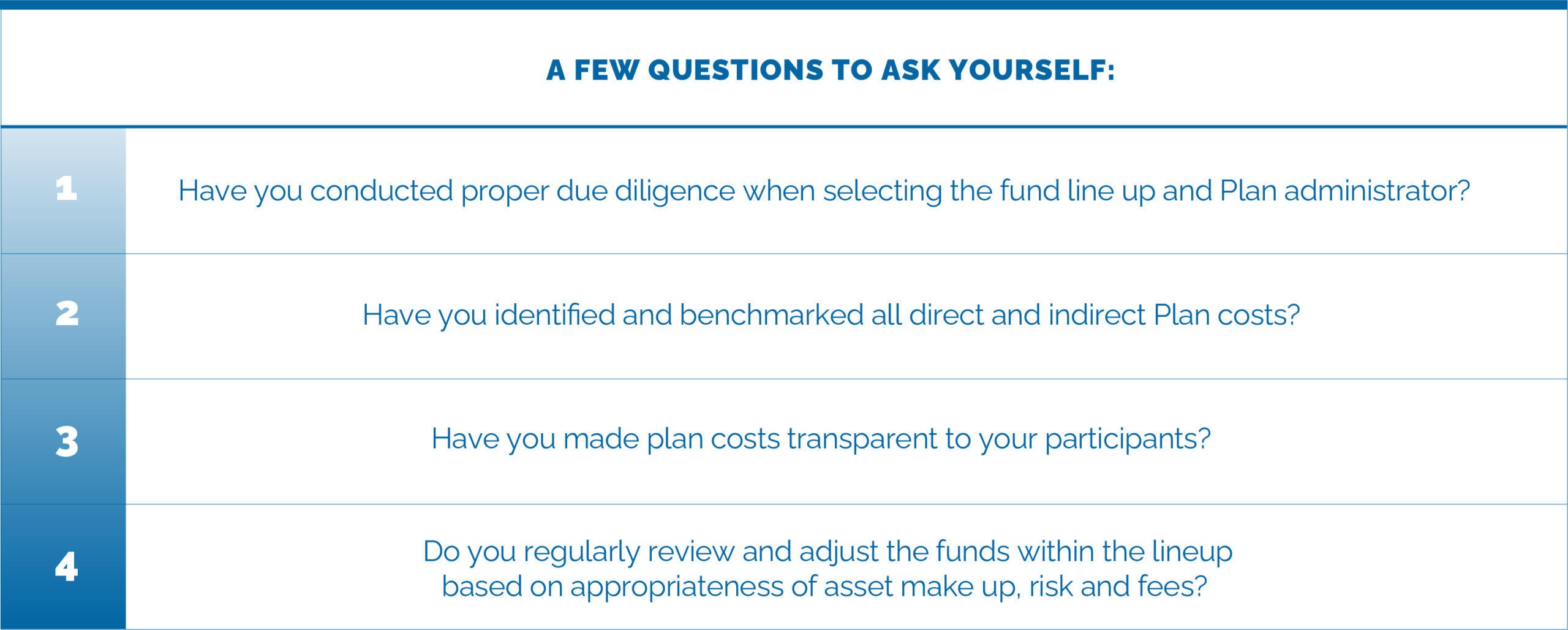

As a Plan fiduciary your actions, or in-actions, are what will be scrutinized by potential claimants. Compliance with fiduciary standards is crucial in both the initial establishment of your plan as well as in continuous on-going monitoring of vendors, investments, fees and regulations.

HOW OPTIMATUM CAN HELP:

The list of questions goes on and on. Ensuring that the Plan is operating with the best interests of its Plan participants is the ultimate test that you need to satisfy.

To improve resilience against these risks, Optimatum supports clients from proactive foundational assessments to on-going Plan management and, while we hope you never need it, addressing plan operational challenges as they arise.

Don’t allow your Plan to become a target for a lawsuit. Be proactive in implementing the best -in-class practices for governance and vendor management.

i. Bloomberg Bureau of National Affairs, ERISA Litigation Tracker

ABOUT OPTIMATUM:

Optimatum is a vendor management firm that focuses exclusively on the HR supply chain with turnkey solutions that improve the financial, operating performance, transparency and accountability of HR Benefit programs while still maintaining existing vendor relationships.

Our support of the HR workstream during the M&A lifecycle encompasses operational due diligence, day-one readiness and post day-one synergies. We assist sponsors in leveraging the aggregate purchasing power of their portfolio to capture value and drive margin expansion.